Risk Management

RISK MANAGEMENT

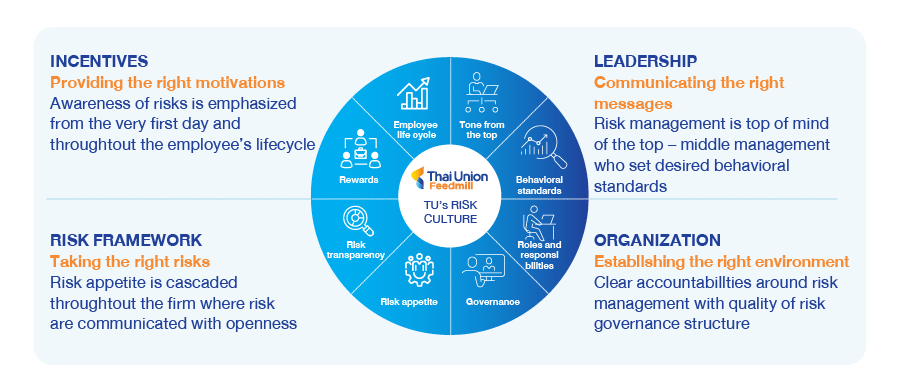

The Company is fully aware that effective risk management and mitigation is an integral part of the Company’s business operations. The Company encourages employees to have a positive attitude to risks and understand inherent risks in this line of business. Together with having the right tools and processes, effective risk management requires the right culture and behaviors across the organization.

RISK MANGEMENT CULTURE

The Company is committed to promoting risk management culture among employees of all levels, starting with the leaders of the organization. The Board of Directors promotes and supervises a systematic risk management process that is integral of the organizational culture. Policy, frameworks, and guidelines are communicated. The risk management structure has been established. Apart from these, risk management has become a key factor in the business decision-making process. In some cases, risk management plans may incur higher costs or adjustments to the operations. However, there is no excuse not to have risk management in place. The Company has implemented risk management in a practical manner. This includes the commitment to sustainable development, disciplines, and business ethics as well as effective internal control. Moreover, the Company encourages employees to be aware of the risk management process from their first day at work until the day they leave the Company, through orientation, trainings, activities, and dissemination of information and news, as well as incentives such as the measurement and evaluation of performance related to risk management.

In addition, risk management is embedded in business planning, decisions and execution. Examples of key areas include:

- Strategic risks are considered in the strategy planning process and during the implementation of initiatives complying with the decided strategy.

- New strategic investments, including M&A, new types of business investment, and large capital expenditure are embedded in risk management. The risk profile will be reviewed by the CEO for suggestions on the adequacy and appropriateness of the risk response.

PLEASE CLICK HERE for more details of Risk management committee

SEEMORE

RISK MANAGEMENT FRAMEWORK

The Company’s risk management framework is in accordance with the international standards of COSO ERM. It is a guideline for management and employees to operate consistently. The framework is designed to identify, assess, manage, monitor, and communicate systematically and consistently in order to minimize the probability of risks occurring and limit their potential impact on Company business. The Company processes risk management at a Group-wide level, and entity level. The quarterly risk exposure review is conducted with entity risk coordinator, risk owner and Risk Management Committee (RMC). In the meantime, RMC quarterly reports significant risks, mitigations, and improvements to the BoD.

In addition, the Company commits to continuous improvement in risk management practices, thus self-evaluation of RMC and employee risk management feedback on risk management process is regularly conducted for further improvement.

KEY RISK FACTOR AND EMERGING RISK

The Company is one of the well-known producers and distributors of aquaculture feeds in Thailand and its operating and financial results are subject to a risk in aquaculture feeds industry. Thus, the Company can assess the risks and prepare for mitigating any impacts and/or minimize likelihood. However, many of them are not within the Company’s control and could impact to the Company’s operations, financial positions and reputation. The Company’s business risk factors that may significantly affect investors’ return on investment and approaches to prevent such risks can be summarized as follows: